Thor Industries reported consolidated net sales for it s fiscal fourth quarter were $2.80 billion, compared to $2.93 billion for the third quarter of fiscal 2023. Consolidated gross profit margin for the third quarter of fiscal 2024 was 15.1 percent, an increase of 30 basis points compared to the third quarter of fiscal 2023. Net income attributable to Thor Industries, Inc. and diluted earnings per share for the third quarter of fiscal 2024 were $114.5 million and $2.13, respectively, compared to $120.7 million and $2.24, respectively, for the third quarter of fiscal 2023.

“We are proud of our teams’ performance as they have executed our variable cost model and driven operating efficiencies and enabled Thor to perform relatively well in a difficult market. Indicators of the long-term prospects for our industry remain very positive; accordingly, we remain very confident in the long-term outlook for our industry and for Thor,” offered President and CEO Bob Martin.

Added Martin, “In our fiscal third quarter, our independent dealers experienced increased retail activity during the Spring selling season; however, conversion to sales remained difficult in light of the economic pressures on retail buyers. Faced with elevated floor plan interest rates, our independent dealers remain understandably cautious with their ordering patterns; consequently, our independent dealer inventory levels remain suppressed. Given the macroeconomic conditions, we see this cautious approach as healthy for our industry and maintain our confidence in a robust return of our top and bottom line performance once macro pressures subside. Until a strong market does return, we will continue to be disciplined with production and will continue to work with our independent dealers to maintain a steady, albeit depressed, retail pull-through by focusing our production on floorplans and price points that resonate with consumers in the current environment. Our dealers have been great partners with us through this cycle, and, together, we will continue to successfully navigate a prolonged challenging market.

Thor’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Segment Results

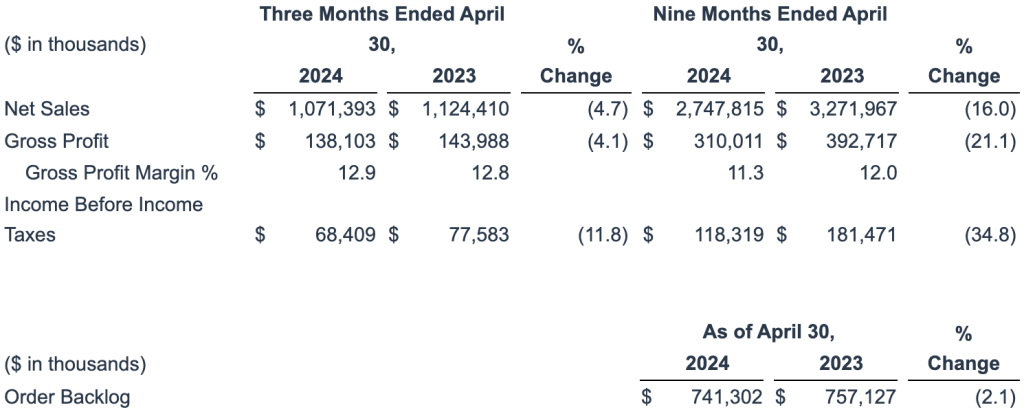

North American Towable RVs

- North American Towable RV net sales were down 4.7 percent for the third quarter of fiscal 2024 compared to the prior-year period, driven by a 15.1 percent increase in unit shipments offset by a 19.8 percent decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to the combined impact of a shift in product mix toward our lower-cost travel trailers and more moderately-priced units with sales price reductions compared to the prior year period.

- North American Towable RV gross profit margin was 12.9 percent for the third quarter of fiscal 2024, compared to 12.8 percent in the prior-year period. The increase in gross profit margin was primarily driven by a decrease in the material cost percentage due to the combined favorable impacts of lower discounting, cost-saving initiatives and product mix changes.

- North American Towable RV income before income taxes for the third quarter of fiscal 2024 was $68.4 million, compared to $77.6 million in the third quarter of fiscal 2023. This decrease was driven primarily by decreases in North American Towable RV net sales.

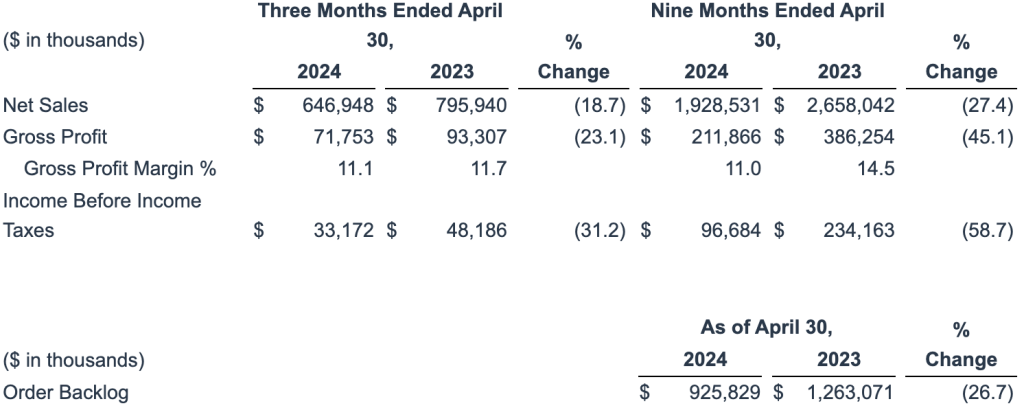

North American Motorized RVs

- North American Motorized RV net sales decreased 18.7 percent for the third quarter of fiscal 2024 compared to the prior-year period. The decrease was primarily due to a 20.0 percent reduction in unit shipments, as current dealer and consumer demand has softened in comparison to the prior-year period, offset by a 1.3 percent increase in net sales due to changes in product mix and net price per unit.

- North American Motorized RV gross profit margin was 11.1 percent for the third quarter of fiscal 2024, compared to 11.7 percent in the prior-year period. The decrease in the gross profit margin for the third quarter of fiscal 2024 was primarily driven by the decreased net sales volume with increased sales discounts and chassis costs.

- North American Motorized RV income before income taxes for the third quarter of fiscal 2024 decreased to $33.2 million compared to $48.2 million in the prior-year period, driven by the decrease in net sales and the decline in the gross margin percentage.

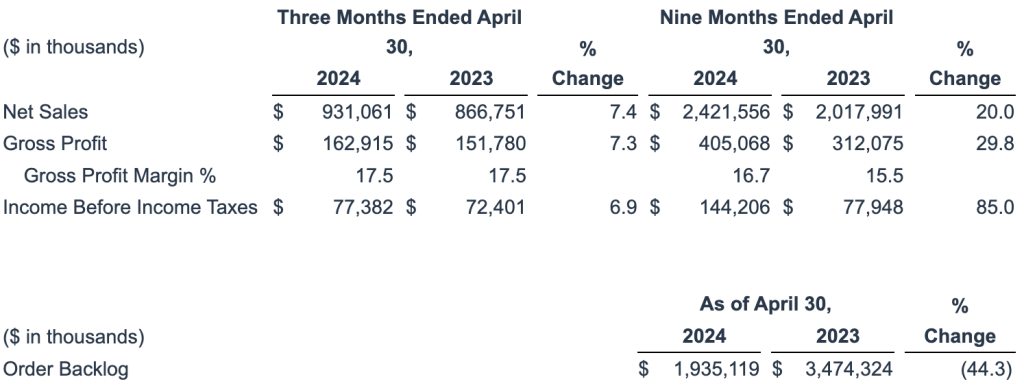

European RVs

- European RV net sales increased 7.4 percent for the third quarter of fiscal 2024 compared to the prior-year period, driven by a 1.5 percent decrease in unit shipments and an 8.9 percent increase in the overall net price per unit due to the total combined impact of changes in product mix and price. The overall net price per unit increase of 8.9 percent includes no impact from foreign currency exchange rate changes, as rates were consistent for the two periods.

- European RV gross profit margin remained constant at 17.5 percent of net sales for the third quarter of fiscal 2024 compared to the prior-year period, primarily due to slight improvements in labor and warranty cost percentages being mostly offset by a slight increase in material costs due to increased sales discounting.

- European RV income before income taxes for the third quarter of fiscal 2024 was $77.4 million compared to income before income taxes of $72.4 million during the third quarter of fiscal 2023, with the improvement driven primarily by the increased net sales compared to the prior year period.

Management Commentary

“As anticipated, our third quarter of fiscal year 2024 experienced a similar inflection as compared to our third quarter of fiscal year 2023, as seasonality provided a boost to our top and bottom lines. On a year-over-year basis, our fiscal third quarter saw a consolidated net sales decline of 4.4 percent while net income before taxes decreased just 20 basis points as a percentage of sales,” said Todd Woelfer, senior vice president and chief operating officer.

Woelfer continued, “In North America, our teams executed the plan by remaining prudent with production and continuing to maximize operating efficiencies as we leveraged our variable cost model, resulting in stronger than anticipated top- and bottom-line performance relative to the market. During the fiscal quarter, we continued to focus on aligning production with retail demand. Our teams have been successful in assisting dealers with driving down their inventory to levels that position both our independent dealers and Thor to be able to maintain performance during a prolonged downcycle and to excel when a stronger market inevitably returns. As we look ahead to our fiscal fourth quarter and the coming model year change, we will continue to be aggressive in working with our dealer partners to keep inventories fresh. Given the challenging retail environment that will persist in our fourth fiscal quarter, we anticipate that increased promotional activity will impact the quarterly margins but will also function to maintain the favorable dealer inventory conditions that we’ve worked hard to achieve during the prolonged down cycle.

“Our European team continues to perform well for the enterprise. As we reported last quarter, our European independent dealer inventories were right-sized by the end of our fiscal second quarter, making the successful third quarter from our European segment particularly meaningful. Fiscal third-quarter net sales for our European segment increased 7.4 percent against a strong prior-year quarter, while net income before income taxes remained relatively consistent at 8.3 percent of net sales. The ability to sustain this level of profitability in a normalized inventory environment is a testament to our European team’s success in executing its plan to drive sustainable operating efficiency and to produce products that resonate with retail customers. Importantly, over the third fiscal quarter, our European segment has shown positive signs of regaining the Motorcaravan and Campervan market share that had been lost in the prior year due to a disproportionate impact from the chassis shortage. Through the first three months of the calendar year 2024, our European Motorcaravan and Campervan market share stands at 25.6 percent as compared to 20.9 percent for the full calendar year 2023. Europe continues to buoy Thor’s consolidated performance through this down cycle, which reaffirms the value of our geographic market diversification strategy, which was central to our acquisition of the Erwin Hymer Group in fiscal 2019. This geographic diversification is an important element of Thor’s value proposition,” concluded Woelfer.

Colleen Zuhl, senior vice president and chief financial officer, said, “Throughout the quarter, we had strong cash generation, exceeding $250.0 million of cash from operations. With the cash generated, we continued to execute our transparent capital allocation strategy as we paid down approximately $161.4 million in debt and repurchased 126,754 shares of our outstanding stock. Capital expenditures in the third fiscal quarter totaled $27.2 million, bringing our nine-month total to just over $106 million. In addition to maintenance, our capital expenditure spend has been focused on bringing the Poland operation of our European RV Segment fully online and, adding capacity and expanding our product lineup at Airxcel. Importantly, as the challenging market lingers longer than expected, we have materially reduced our capital investments from our initial forecast and have focused on funding more time-sensitive initiatives like the aforementioned investments necessary to expand Airxcel’s product offerings. Our liquidity remains a unique strength within the industry. On April 30, 2024, we had liquidity of approximately $1.37 billion, including approximately $371.8 million in cash on hand and approximately $998.0 million available under our asset-based revolving credit facility. As we continue to navigate a dynamic market, our financial strength and robust cash generation profile continue to enable us to perform well relative to the market conditions and to execute our long-term strategic plan.”

Outlook

“As we discussed last quarter, we expected a seasonal lift to our top and bottom lines in our fiscal third quarter. As we exit that quarter, we are mindful that we also exit the prime selling season of our industry. Macroeconomic conditions remain a headwind to our markets. Additionally, this summer, consistent with normal industry practice, we will introduce a new model year lineup. As that happens, we will remain focused on ensuring that dealer inventory remains fresh. We are also going to maintain operational discipline and will not chase temporary market share gains that require excessive degradation to our margins and the value of our brands. Accordingly, the confluence of these factors will impact our fiscal fourth quarter,” said Martin.

“We have experienced many of these down cycles in our history. That history demonstrates that our experience in managing through cycles creates opportunity for Thor. This cycle is no different—challenging in the short term with opportunity in the longer term. At times like this, we also materially benefit from being purely an RV company which allows us to focus on maximizing our performance in our market without having to simultaneously face the challenges from other markets. We execute to our down cycle playbook and leverage our deep bench of talented and experienced teams when macro conditions present a challenging market. Our operating model enables us to generate cash even during a difficult market. As we have done that this year, we have returned value to our shareholders by staying true to our capital allocation strategy by investing in our business, managing our debt conservatively, buying back over 454,000 shares of our stock and raising our dividend,” added Woelfer.

“Although the near-term environment remains challenging, we continue to be very optimistic about global consumer interest in the RV lifestyle and long-term demand for our products. Our strong financial position and status as the global leader in the RV industry enable Thor to meet the challenges of the current market and position the company for success in the longer term. While we are realistic about the market we currently face, we are likewise realistic with our optimism for the future of the company. That optimism is based on the fundamentals of our business, our people, our long-term strategies, and an undeniably robust interest in the RV lifestyle on a global basis,” added Martin.

Fiscal 2024 Guidance

The company’s fiscal 2024 guidance has been revised to reflect challenging market conditions that have persisted into the fourth quarter of fiscal 2024. Based on current North American order intake levels through the end of May, the company is lowering its guidance ranges to reflect a lowered fiscal year 2024 North American industry wholesale shipment range of between 315,000 and 325,000 units, which is more conservative than our previous shipment range of between 330,000 and 340,000 units.

For fiscal 2024, the company’s updated full-year guidance now includes:

- Consolidated net sales in the range of $9.8 billion to $10.1 billion (previously $10.0 billion to $10.5 billion);

- Consolidated gross profit margin in the range of 13.75 percent to 14.0 percent (previously 14.0 percent to 14.5 percent)

- Diluted earnings per share in the range of $4.50 to $4.75 (previously $5.00 to $5.50)

“The prolonged market downturn has persisted longer than we, and most others in and around the industry, anticipated as the macro challenges continue to impact our independent dealers and consumers. We believe that this persistence will restrict both our top and bottom lines for our fiscal fourth quarter. Our realistic view of our fiscal fourth quarter necessitates a reduction in our previous guidance forecasted after our fiscal second quarter,” concluded Martin.

Image courtesy Thor Industries