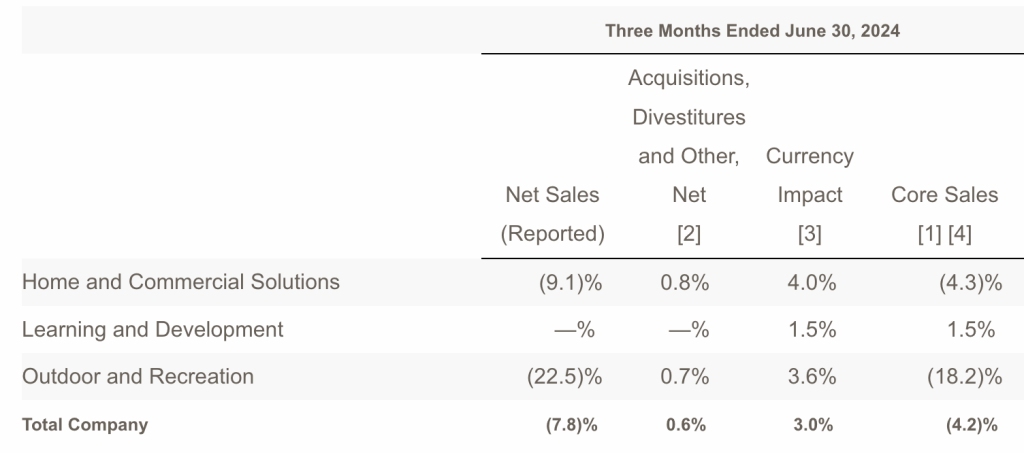

Newell Brands, the parent company of Marmot, Ex Officio, Stearns, Bubba, Coleman, and Contigo, among others, reported that the company’s Outdoor & Recreation segment continued its declining fortunes in the second quarter as sales fell 22.5 percent to $258 million compared with $333 million in the prior year Q2 period.

The company said the decline reflected a core sales decline of 18.2 percent, in addition to the impact of unfavorable foreign exchange and certain business exits.

The segment’s reported operating loss was $11 million, or negative 4.3 percent of sales, in the second quarter, compared with operating income of $5 million, or 1.5 percent of sales, in the prior-year Q2 period. Normalized operating loss was $1 million, or negative 0.4 percent of sales, compared with normalized operating income of $14 million, or 4.2 percent of sales, in the prior-year Q2 period.

Core Sales Growth by Segment

“Core Sales” provides a consistent basis for year-over-year comparisons in sales as it excludes the impacts of acquisitions, completed and planned divestitures (including the sale of the Millefiori business), retail store openings and closings, certain market and category exits, as well as changes in foreign currency.

Consolidated Results

Newell Brands reported consolidated net sales were $2.0 billion in the second quarter, a 7.8 percent decline compared with the prior-year Q2 period, reflecting a core sales decline of 4.2 percent, as well as the impact of unfavorable foreign exchange and business exits.

Pricing in international markets to offset inflation and currency movements was said to be “a meaningful contributor” to the company’s core sales performance.

The reported gross margin increased to 34.4 percent of net sales in the quarter, compared with 28.5 percent in the prior-year Q2 period. Normalized gross margin increased to 34.8 percent compared with 29.9 percent in the prior-year Q2 period.

Reported operating margin increased to 8.0 percent of net sales in Q2, compared with 5.4 percent in the prior-year Q2 period. Normalized operating margin increased to 10.8 percent compared with 9.1 percent in the prior-year Q2 period.

Second quarter reported net income was $45 million, or 11 cents per diluted share, in second quarter, compared with $18 million, 4 cents per diluted share, in the prior-year Q2 period.

Normalized net income was $151 million, or 36 cents per diluted share, compared with $101 million, or 24 cents, in the prior-year Q2 period.

Normalized EBITDA increased to $284 million in Q2, compared with $258 million in the prior-year Q2 period.

Balance Sheet and Cash Flow

Year-to-date operating cash flow was $64 million compared with $277 million in the prior-year Q2 period. The prior year included significant contribution from working capital. Inventories have decreased by approximately $300 million versus the prior-year Q2 period.

At the end of the second quarter, Newell Brands had debt outstanding of $5.0 billion and cash and cash equivalents of $382 million, compared with $5.4 billion and $317 million, respectively, at the end of the second quarter of 2023.

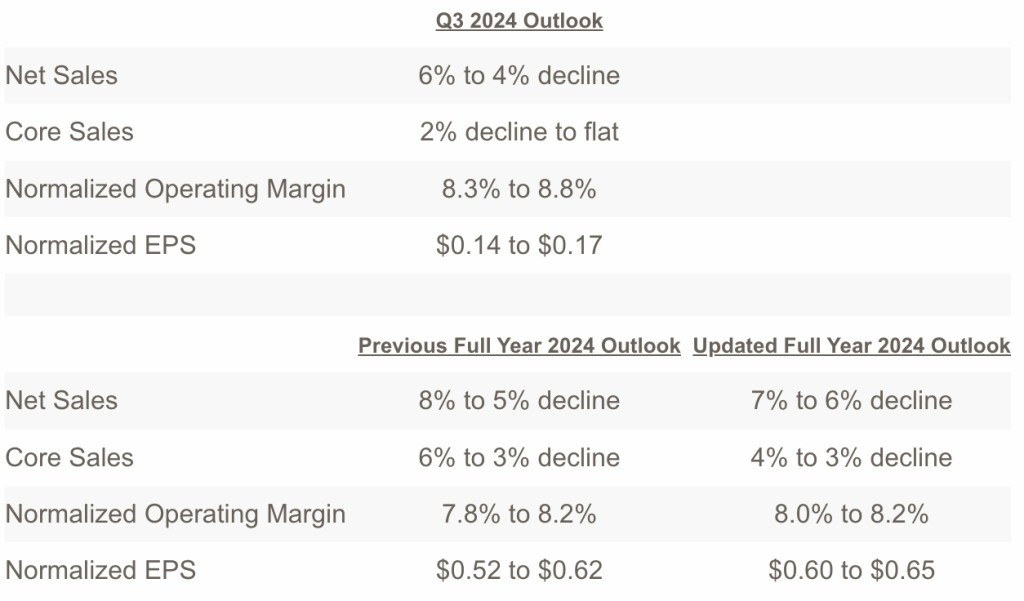

Outlook for Third Quarter and Full Year 2024

The company initiated its outlook for third quarter 2024 and raised its full year 2024 outlook.

The company also increased its outlook for full year 2024 operating cash flow to a range of $450 million to $550 million from the previous range of $400 million to $500 million. The operating cash flow outlook continues to assume approximately $150 million to $200 million in cash payments associated with restructuring and related initiatives.

Image courtesy Coleman