Smith & Wesson Brands, Inc. (SWBI) wrapped up the final quarter of its 2024 fiscal year through April 30, delivering another strong quarter amid falling NICS background checks that may indicate a slowing of the broader firearms market.

Mark Smith, president and CEO told a group of analysts on a conference call that the fiscal 2024 results again demonstrate that the company’s “relentless focus” on long-term strategies consistently reinforces its position as a market leader delivering solid stockholder returns.

“Our Q4 top-line revenue was up 10 percent versus last year, driven by unit growth in both handguns and long guns,” Smith shared with the group. “We believe this reflects robust market share gains as our shipments once again outpaced the overall firearms market, driven, once again, by excellent consumer reception to our new product offerings as well as sustained demand for our core product portfolio.”

Net sales for the fourth quarter amounted to $159.1 million, up 9.9 percent versus the prior-year comparable quarter, with new products making up 29.1 percent of total revenue.

CFO Deana McPherson called out the 1854 Lever Action Rifle launch in January, which was met with significant consumer interest. In addition, she said the new M&P 15 Sport III and SD9 2.0 performed well in their categories.

In the sporting goods channel, the company’s long gun unit shipments increased by over 14 percent versus the year-ago period and handgun shipments were said to be up almost 8 percent, while the overall market, as measured by NICS checks, was down 6 percent in long guns and down 7 percent in handguns.

“Innovation continued to be a key driver, with new products making up just under 30 percent of sales, led by the 1854 Lever Action Rifle,” Smith added. “And despite the outperformance in our out-the-door unit shipments into the channel, inventory levels during the period at our distributor and strategic retail partners remained healthy.”

Smith said another bright spot for the quarter was overall ASPs, which continued to hold at healthy levels despite the competitive landscape and new lower-priced handgun products introduced.

“We believe this reflects the consumers’ trust in the Smith & Wesson brand to deliver world-class quality firearms, innovation and customer service,” Smith said. “Handgun ASPs largely held steady, declining less than 2 percent versus the prior-year quarter, mostly driven by mix factors associated with introducing the very popular new entry-level priced SD 2.0 9 millimeters, whereas long gun ASPs beat expectations by improving by nearly 11 percent.”

Smith said the long gun ASP increase was due to the launch of the 1854 Lever Action Rifle, hailed by the industry and consumers as an instant classic, is in high demand.

“As I covered last quarter, this successful launch creates an exciting new white space opportunity for Smith & Wesson,” Smith expanded. “Our near-term category expansion plans include the introduction of new line extensions this summer and throughout the hunting season. We also expect to add significant new capacity this fall to support the strong demand for our new products, helping to propel our top-line growth in the second half.”

McPherson reported that gross margin was 35.5 percent of net sales in Q4, up 650 basis points above the prior-year comparable quarter, reflecting a combination of favorable fixed cost absorption due to “increased production volume, higher long gun ASPs, driven by new products, increased sales volumes and lower promotions, partially offset by the impact of inflation on material and labor costs and increased inventory reserves.”

Operating expenses of $31.1 million for the fourth quarter were $7 million higher than the prior-year comparable quarter, said to be due to increased profit-related compensation costs, including profit sharing, which is now recorded in the quarter it is earned and increased legal costs combined with the impact of a year-to-date reclassification of sublease income from other income to operating expenses in the prior year.

GAAP net income was $26.1 million, or 57 cents per diluted share, for the quarter, compared with $12.8 million, or 28 cents per diluted share, for the comparable quarter last year, said to be due to “a combination of higher net sales, improved gross margin and a $6.5 million sale of intangible assets, partially offset by profit-related compensation costs.”

Non-GAAP net income was $20.9 million, or 45 cents per diluted share, in Q4, compared with $14.6 million, or 32 cents per diluted share, for the comparable quarter last year.

GAAP to non-GAAP adjustments for income reportedly include a gain related to the sale of certain intangible assets and other costs.

“On the bottom line, the team delivered solid non-GAAP EPS of $0.45 in Q4,” Smith added. “This was driven by increased production rates to meet the demand for our new products and to maintain target inventory levels on our core offerings, as we mentioned last quarter. We also benefited from continuing stabilization of the Tennessee operations and have begun realizing the associated efficiencies.”

McPherson said that SWBI generated $43.6 million in cash from operations and spent $5.6 million on capital projects, resulting in net free cash of $38 million.

“During the quarter, we repurchased approximately 77,000 shares at an average price of $14.12 for a total of $1.1 million,” she reported.

“Subsequent to year-end, we’ve already repurchased approximately 137,000 shares at an average price of $16.07, and we still have nearly $38 million remaining on our authorization. We paid $5.5 million in dividends, repaid $25 million on our revolving line of credit, and ended the quarter with $60.8 million in cash and $40 million in borrowings on our line of credit.”

Full Year Fiscal 2024 Financial Highlights

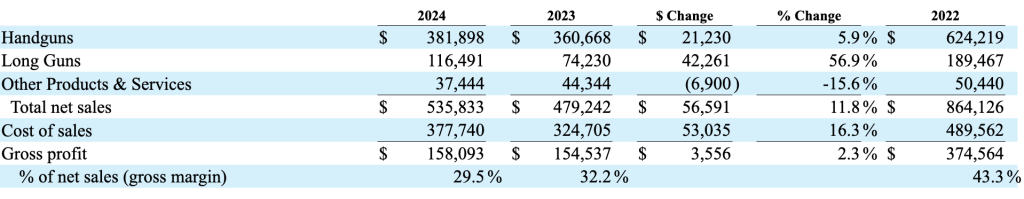

- Net sales were $535.8 million, an increase of 11.8 percent, over the prior fiscal year.

- Gross margin was 29.5 percent of net sales compared with 32.2 percent in the prior fiscal year.

- GAAP net income was $39.6 million, or 86 cents per diluted share, compared with $36.9 million, or 80 cents per diluted share, for the prior fiscal year.

- Non-GAAP net income was $42.6 million, or 92 cents per diluted share, compared with $43.3 million, or 94 cents per diluted share, for the prior fiscal year.

- GAAP to non-GAAP adjustments for income include a gain related to the sale of certain intangible assets, costs related to the move of the company’s headquarters and significant elements of its operations to a new facility in Maryville, TN, an accrued legal settlement, and other costs.

- Non-GAAP Adjusted EBITDAS was $94.3 million, or 17.6 percent of net sales, compared with $95.2 million, or 19.9 percent of net sales, for the prior fiscal year.

CEO Smith said the company launched over 100 new products during the fiscal year, accounting for over 27 percent of total revenue.

“We grew revenue and units shipped by nearly 12 percent and 13 percent, respectively, outpacing NICS, which was down by 5.4 percent,” Smith reiterated. “We generated over $106 million in cash from operations, ending the year with over $60 million in cash on hand and only $40 million in debt and reduced inventory by $16.6 million. We delivered significant value to our stockholders, including $22 million in dividend payments and $10.2 million in share repurchases.”

SWBI spent $90.8 million on capital projects, resulting in net free cash of $16 million for the fiscal year.

With less than $5 million remaining to spend on the relocation and normal operating capital returning to our historical levels of $25 million to $30 million, the company’s Board has reportedly authorized an 8.3 percent increase in the company’s quarterly dividend, raising it to 13 cents to be paid to stockholders of record on July 11 with payment to on July 25, 2024.

Looking ahead, Smith said the company continues to expect healthy demand for firearms in fiscal 2025 and believes it is well positioned to deliver another solid year of growth.

“At the same time, we are anticipating a much more competitive marketplace throughout the traditionally slower summer month this year as consumer discretionary spending continues to be impacted by stubborn inflation, as you have likely seen from recent NICS results,” Smith cautioned. “This is consistent with normal seasonal patterns for firearms demand, and we do expect offsetting tailwinds during our typical busy season throughout the second half, as the presidential election campaign activity ramps up in the fall and we benefit from new product introductions and we bring online additional capacity targeted at some of our new products where we are currently constrained.”

Smith added that during the slow summer period, the company would be “aggressively pursuing market share through promotions and marketing campaigns,” building inventory in preparation for the busy fall season and continuing its cadence of new product introductions.

“Specifically, with consumers increasingly price sensitive as inflation impacts discretionary spending, we will be focused on addressing this with new entry-level price launches this summer, which we believe will provide tailwinds in Q2 and throughout the second half,” the CEO shared.

Outlook

“Looking forward to fiscal 2025, as Mark mentioned, we continue to expect healthy demand for firearms in fiscal 2025 and believe we are well-positioned to deliver another year of solid growth,” McPherson added, laying out the 2025 outlook. She said the company expects sales growth in the mid- to high-single-digits.

“With near-term demand softer than we originally anticipated, sales will be more weighted to the second half of the fiscal year,” the CFO explained. “We expect Q1 to be down approximately 10 percent from the prior-year quarter in terms of units and dollars as growth in long guns partially offsets a decline in handguns. We expect Q2 to rebound a bit as we approach the election, resulting in the first half being only moderately down to last year.”

The CFO said SWBI expects the second half to benefit from normal seasonal increases, new product introductions and investments in increased capacity.

“We believe channel inventory is in a good spot and, therefore, we are not anticipating a material impact from inventory changes, either internally or externally,” she said. “With regard to pricing and ASPs, we expect some headwinds in handguns, particularly during normal summer slowdown. But believe that long guns will remain reasonably strong due to new products.”

SWBI expects margins to stabilize in the low 30 percent range for the full year, an improvement over fiscal 2024, with normal quarterly fluctuations impacted by both volume and operating days. Margins will be affected by the full-year impact of operating our Tennessee facility, which moves certain building costs out of distribution into cost of sales combined with one-time costs associated with facility consolidation. With respect to the first quarter gross margin, McPherson said they expect it to be in line with the prior-year first quarter levels.

“The expected benefits associated with automation and the reduced facility footprint will begin to more be fully realized later this year,” McPherson offered. “Although we don’t expect that the rate of inflation will materially change in fiscal ’25, we should benefit from a more level- loaded manufacturing operation in stable channel inventory, which will help margins for the full year.”

Operating expenses for the full year are reported to likely be 3 percent to 5 percent higher due to compensation-related inflation and a more competitive market and an increased investment in R&D. Adjusted EBITDAS is expected to grow at a similar rate to sales in fiscal 2025.

The effective tax rate is expected to be approximately 24 percent.

“As we covered earlier and, as I said last quarter, we expect the firearms market to experience healthy demand through the 2024 election cycle and fiscal 2025,” Smith reiterated in closing. “And with our deep pipeline of new products, leading brand, new state-of-the-art facility now operational, strong balance sheet and, most importantly, world-class dedicated employees, we are excited for another year of growth and to continue delivering value for our stockholders.”

Images/Chart courtesy Smith & Wesson Brands, Inc.