The holidays already? Really? It would not be surprising to see the decorations right around the corner, but many forget about the thoughtful and meticulous planning that major retailers, at least those that depend on the holidays to make the year, how much effort they put into the season and how far in advance they start. It’s like the NFL. The planning for next year begins right after the last game of the season, or in this case, the previous January sale.

Giving retailers an assist in changing the process in First Insight, a company focused on predictive analytics and Voice of Customer (VoC) solutions. First Insight provides retail a head start on this year’s holiday sales, by focusing on the business of preparing for the holiday season.

The research firm’s latest report, “Retailers’ Blind Spot for Holiday 2024,” highlights the critical uncertainties retailers face as they prepare for the upcoming holiday season. It emphasizes the need for integrating predictive analytics with consumer insights to optimize pricing, promotions and marketing strategies. In other words, what are they doing differently to get a leg up?

“To truly succeed in the fast-paced retail world of 2024, it’s time to look up and focus on the horizon,” noted First Insight in its report. “VoC data is your windshield, giving you a clear view of your customers’ current needs and desires. Predictive analytics is your navigation system, processing this information to plot the best course forward.”

The company said in a media release that the report, based on a May 2024 survey of U.S. retail decision-makers, shows retailers grapple with concerns about promotional effectiveness, inventory levels, and customer acquisition and retention.

The top concerns First Insight identified include:

- Promotional Strategies: Retailers are still determining whether their promotional strategies will be too reactive rather than strategic.

- Inventory Management: There is a significant concern about having enough of the right merchandise in stock.

- Customer Alignment: Retailers are not confident that their planned assortments will resonate with target consumers.

“With rising inflation costs, retailers have much to worry about, especially whether the products they bought will be what consumers are willing to spend their money on,” said Greg Petro, CEO of First Insight. “This makes it imperative for retailers to ensure their offerings align with consumer expectations.”

In the report, Retailers cited their top data and insight sources, the top three of which were either backward-looking or derived from third-party data. Over half (53 percent) used the previous season’s sales histories, 49 percent used trend services and reports and 42 percent relied on customer comments and reviews from their websites.

The report also highlights the external pressures facing retailers, such as the impact of inflation on consumer spending and the competitive threat from online marketplaces, including TikTok Shop. With inflation cited as the number one external concern, retailers are wary of its potential to reduce consumer discretionary spending on gifts and other holiday-related purchases.

While not included in the survey questions, retailers may also have to consider the impact of the twists and turns in the U.S. election cycle on the consumer’s willingness to spend.

First Insight noted that retailers have found themselves at the mercy of economic forces and cultural whims as Holiday 2024 approaches.

“The consequences of inflation continue, threatening to further drive up prices of essentials like gasoline and groceries,” the company wrote in the report. “This financial pressure on consumers feels like an invisible hand, shaping shopping behaviors beyond retailers’ grasp. Simultaneously, the unpredictable nature of social media-driven trends is continuing to keep executives on edge, as a single viral TikTok video could make or break a product’s success overnight.”

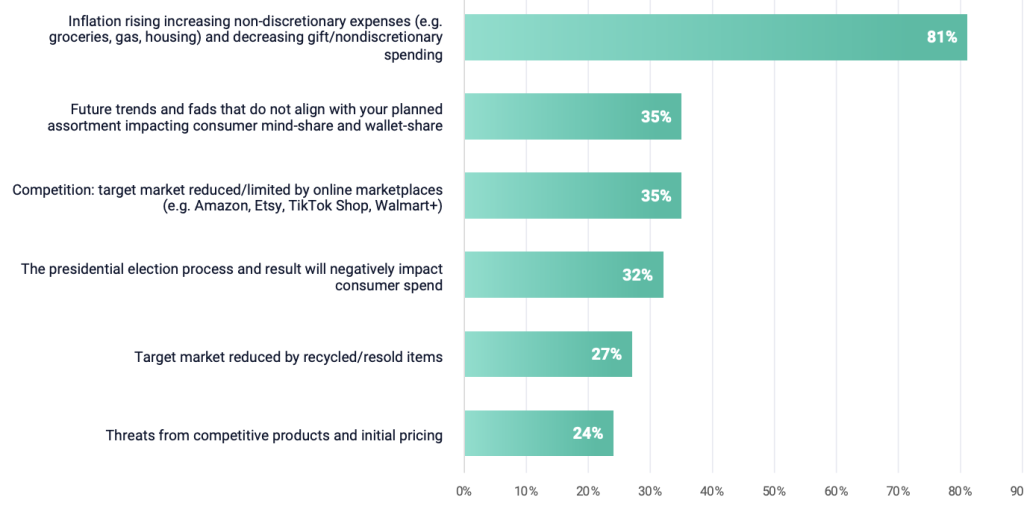

External Threats Outside Retailers’ Control

When asked for the top three factors beyond their control, 81 percent of respondents cited inflation. Respondents stated that rising prices for essentials, including groceries and gas, would negatively impact consumer spending on discretionary items.

While inflation appears to be moderating, grocery prices continue to grow and have reportedly increased between 25 percent and 34 percent since March 2021, outstripping the overall pace of inflation during that same time period. Wages have grown slower.

Future Trends and Fads that do not align with the retailer’s planned assortment, impacting consumer mind-share and wallet-share, were cited by 35 percent of respondents.

Competition, notably target market reduced/limited by online marketplaces, was cited by 35 percent of survey respondents when considering Amazon, Etsy, TikTok Shop, and Walmart+.

The Presidential election process and the outcome were cited by 32 percent of respondents as having a potentially negative impact on consumer spending this holiday season.

Key Findings from the Report

(respondents selected the Top 3 factors)

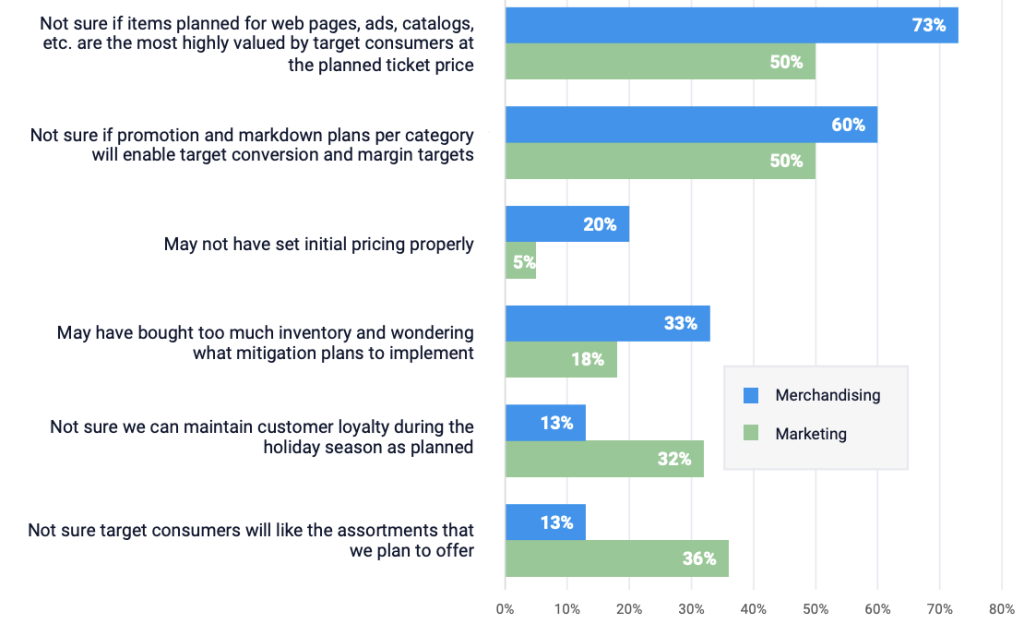

Reconciling Divergent Marketing and Merchandising Concerns

(selected the Top 3 concerns)

The report looks at retailers’ top concerns and critical uncertainties as Holiday 2024 approaches.

The Merchandising team may focus on Promotional Timing and Depth as retailers struggle with the timing and depth of markdowns, which are crucial for attracting consumers while maintaining margins.

- Will their promotional strategies be too reactive?

- Have they stocked enough of the right merchandise?

- Can they effectively manage markdown timing and percentages?

“These pressing questions reveal a deeper, more troubling issue: retailers lack the actionable, reliable data needed to make confident decisions about the upcoming season,” First Insight wrote in the report. “This information gap is the true challenge lurking behind their surface-level concerns, threatening to undermine their holiday performance.”

For the Marketing team, the primary focus could be Customer Acquisition and Retention. Attracting new customers and maintaining loyalty among existing ones remain significant challenges.

- Are they hitting margin targets?

- Are they reaching target customers?

- Are they promoting the right product?

“Marketing teams are navigating a minefield of uncertainties this holiday season,” the report observed. “Will their promotions captivate shoppers? Have they indeed identified their target audience? Are the products highlighted in their ad campaigns the ones consumers value the most? These pivotal questions loom, threatening the success of the retailer’s holiday strategies. Seeking direct feedback from target consumers about planned items and pricing is invaluable.

Voice of Customer Insights

One of the report’s significant insights is the misalignment between marketing and merchandising teams. Often operating in silos, these teams struggle to synchronize their strategies, leading to ineffective promotions and mismatched inventory levels. By sharing consumer insights on pre-season items, customer-valued products and initial pricing expectations, both teams can better align their efforts for success. First Insight’s report suggests that by coupling VoC data with AI and predictive analytics, retailers can move from a reactive to a proactive stance.

Assessing Conflicting Merchant and Marketing Concerns

(respondents from each group selected their Top 3 concerns)

First Insight suggests that retailers need to imagine these two teams sharing:

- Consumer insights on pre-season items (predicted winners per assortment);

- Customer-valued items to highlight in marketing campaigns; and

- Initial pricing and promotion expectations based on Voice of Customer (VoC) insights

First Insights believes the combined merchandising and marketing teams can deliver winning results with this data.

“Preparing for this upcoming holiday season presents a pivotal opportunity for retailers to rethink their strategies for future seasons,” added Petro. “By focusing on customer insights and integrating AI-driven predictive analytics, they can focus their sights on where they’re going, and not where they have been.”

Navigating Holiday Decisions with Outdated Tools

For Holiday 2024, First Insight suggests that many retailers are navigating with outdated maps. Historical data misleads in a rapidly evolving retail landscape. The solution? Leveraging their most valuable resource—their customers’ voices.

First Insight said that VoC data, when properly harnessed, provides a window into future consumer behavior. Unlike historical sales data or current product reviews, VoC insights capture consumer sentiments, preferences and intentions for upcoming seasons.

This company said in the report that a forward-looking approach is crucial in today’s fast-paced retail environment, where trends can shift overnight. However, many retailers often fail to amplify these insights with AI-driven predictive analysis.

“Without this crucial step, they are left with a limited view based on last year’s winners and losers, 3rd party market trends, and customer reviews of current products—all of which tell them where they’ve been, not where they’re going,” the company said.

First Insight reported that combining VoC data with predictive analytics enables faster, better decisions for future seasons. By gauging target consumers’ price expectations for Holiday 2024 items, retailers can:

- Set initial pricing,

- Determine price elasticity and

- Predict product success.

Conclusion

Imagine steering your retail business into the bustling Holiday 2024 season while fixated on your rearview mirror. First Insight said that is essentially what retailers do when relying solely on past sales data and old customer reviews. They are navigating the complex retail landscape with their eyes locked on where they’ve been, not where they’re going.

To succeed in the fast-paced retail world of 2024, First Insight said it’s time to look up and focus on the horizon. The company is pitching that VoC data is your windshield, giving a clear view of your customer’s current needs and desires. Predictive analytics is your navigation system, processing this information to plot the best course forward.

First Insight believes retailers can transform their holiday strategy by adjusting their mirrors, starting to look ahead, and confidently driving their brands into a successful holiday season.

Download the full report here.

Methodology

First Insight’s findings are based on a May 2024 survey executed through InsightSuite, with responses from 104 U.S. retail decision-makers. The company sorted and filtered the responses based on role, title, company size, and retail sector. The analysis focused on feedback from merchandising, marketing and consumer insights management at retailers and vertically integrated brands, offering apparel, footwear and home décor items.

First Insight said “it is the global leader in Voice of the Customer retail solutions, transforming business decision-making through actionable consumer insights and AI.”

Image courtest Bergdorf Goodman, Data and Graphics courtesy First Insight/Retailers’ Blind Spot for Holiday 2024