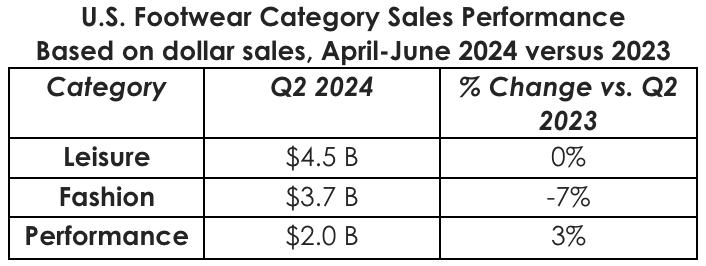

U.S. footwear sales in the second quarter were reportedly $10.2 billion, down by 2 percent versus the same period in 2023, according to data compiled by Circana, the retail tracking service.

*Source: Circana, Retail Tracking Service, excluding direct-to-consumer (DTC) sales, dollar sales adjusted for 53rd week in January 2024

“I can’t really position it any other way. Performance and sport lifestyle sneakers continue to be the winning categories in the footwear market,” said Beth Goldstein, footwear and accessories analyst, Circana. “They are the choice of footwear not only for activity but also for casual and fashion purposes. Comfort and versatility features are also helping athleisure sneakers to gain share, and what’s old is new again—sport-inspired retro is driving growth. We can expect these segments to remain strong during the back-to-school season.”

Highlights for the quarter from Circana data show:

Running shoe sales increased by 8 percent in Q2, based on dollars, with road running shoes leading and trail running and track and field also growing sales.

Soccer/Football, Tennis/Pickleball, and Walking shoes also grew in the performance category.

In the Athleisure space, sport-inspired fashion shoes continue to drive interest in key items across the basketball, soccer/football, cross-training, tennis, and running-inspired categories.

In Women’s Fashion, seasonless shoe options outperformed seasonal categories, with mules, clogs, flats, and ballerinas all showing growth. Sandal sales declined -8 percent.

*The data in this report comes from Circana’s monthly point-of-sale footwear database, which the company collected from the athletic specialty and sporting goods, premium, mid-tier, shoe chain, and other channels.