SGB Executive Apparel

EXEC: Royal Robbins Parent Sees “Disappointing” Q2 as Inventory Woes Persist

Fenix said the retailer market still faced a situation with higher-than-normal inventory, as well as volatile trading because of weather and said there are also indications that a number of retailers are facing some liquidity/financial problems.

EXEC: Sports Direct Parent Sees Adjusted Profit Up Double Digits as Sales Inch Up

Excluding the impact of the 53rd week in fiscal 2023, Retail revenues increased by 0.6 percent year-over-year to £5.54 billion for the 52-week fiscal 2024 period ended April 28.

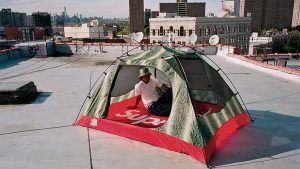

EXEC: Wall Street Sounds Off on VF Corp’s Supreme Sale

SGB Executive compiled input from notes produced by a range of Wall Street sell-side analysts to get a feel for how the deal is being viewed and measure if the perspectives of the Street are fairly universal. They were not.

EXEC: VF Corp. Divests Supreme Brand to Oakley Parent in Cash Deal

The transaction is expected to close by the end of calendar year 2024, subject to customary closing conditions and regulatory approvals. The $1.5 billion sale of Supreme is expected to be dilutive to VF’s earnings per share in fiscal 2025.

EXEC: Adidas Raises Full-Year Outlook Again After Double-Digit Q2 Growth

In euro terms, the company’s revenues grew 9 percent to €5.82 billion from €5.34 billion in Q2 last year. Excluding Yeezy sales in both years, currency-neutral revenues increased 16 percent for the quarter.

EXEC: Asics raises Full-Year Forecast on Strong H1 and Q2 Results

Net sales for the full year are expected to reach a record high of ¥660 billion with updated currency exchange rates, an increase of 15.7 percent versus ¥570.5 billion in fiscal 2023, excluding FX rate fluctuations.

EXEC: Decathlon Creates Independent Investment Entity

An independent entity within the Decathlon Group, Decathlon Pulse is expected to invest in “innovative people and businesses that share its values and commitment.”

EXEC: Xtep Intl Sees Accelerating Q2 Growth for the Core Xtep Brand

The company posted 10 percent year-over-year growth for the offline and online channels in China with a discount level calculated at approximately 25 percent for the three months ended June 30.

EXEC: 361 Degrees Boasts Record Growth During China’s 618 Shopping Period

Throughout the nearly 30-day “618” period, 361 Degrees said the 361° brand emerged as a prominent player, ranking among the Top 5 of all footwear brands, and standing as the sole domestic brand on the Top 30 list. The “Flying Flame 3” reportedly topped the chart as the best-selling professional marathon running shoe.

EXEC: Anta Sports Sees Fila’s China Retail Sales Growth Slow in Q2

The Fila brand increased in mid-single-digits year-over-year in the second quarter, a moderation from the high-single-digit first quarter trend and the high-teens trend for full year 2023.

EXEC: Footwear Factories See Diverging Trends in June

Yue Yuen’s footwear manufacturing revenue grew 2.9 percent year-over-year in June 2024 while Feng Tay Enterprises reported footwear manufacturing revenues were essentially flat for the month of June, rising just 0.8 percent

EXEC: Tom Peddie Returns to Nike as VP of Marketplace Partners

Executive search firm MacGregor Black noted the reappointment on Tuesday morning on LinkedIn, saying that the “move comes as the iconic sports brand looks to enhance its relationships with existing retailers such as Foot Locker.”

EXEC: Columbia Sportswear Shares Tick Up on Analyst Upgrade

The last big jump for Columbia came after 2024 first-quarter results surpassed analysts EPS expectations and revenue also came in ahead of consensus estimates. COLM shares jumped 10.6 percent at the time. COLM shares are now flat for the year.

EXEC: New Report Sees E-Commerce Growth Rate Contracting 70 Percent by 2029

According to data presented by Stocklytics.com, the annual growth rate in the e-commerce sector is now expected to slow to just 4.6 percent by 2029, or 69.3 percent lower than the forecasted 2024 growth rate.

EXEC: Vista Outdoor Rejects MNC Final Offer as CSG Ups Ammo Segment Offer to $2.1B

Vista Outdoor Board unanimously recommended the CSG offer to acquire Vista’s Kinetics Group ammo segment, and it unanimously rejected MNC Capital’s final indication as inadequate and opportunistic, particularly in its undervaluation of the Revelyst outdoor products segment.